AT&T (NYSE:T) has had a group of employees that have broken the rules. As expected the stock rallied possibly due to a bullish hammer on the daily chart. T is not a big mover but it still in the green after the news. It has been added to the paper portfolio of hacked stocks.

Tag: investing

Target Sales Less Ugly Than Expected

Target Q1 Earnings are out. EPS .70 vs .71 and TGT is up about .26% at this moment. The company is recovering from the Polar Vortex and a less than stellar entry into the Canadian market. This is within expectations and the stock is approaching a support level. Keep an eye out for a touch of the low and a bounce.

Target Data Breach Not A Disaster

Everybody loves a good hacking because it spells doom for the target in question. In this case the target in question is Target. We’re going to delve into the financials and see that once again a hacking is no big deal.

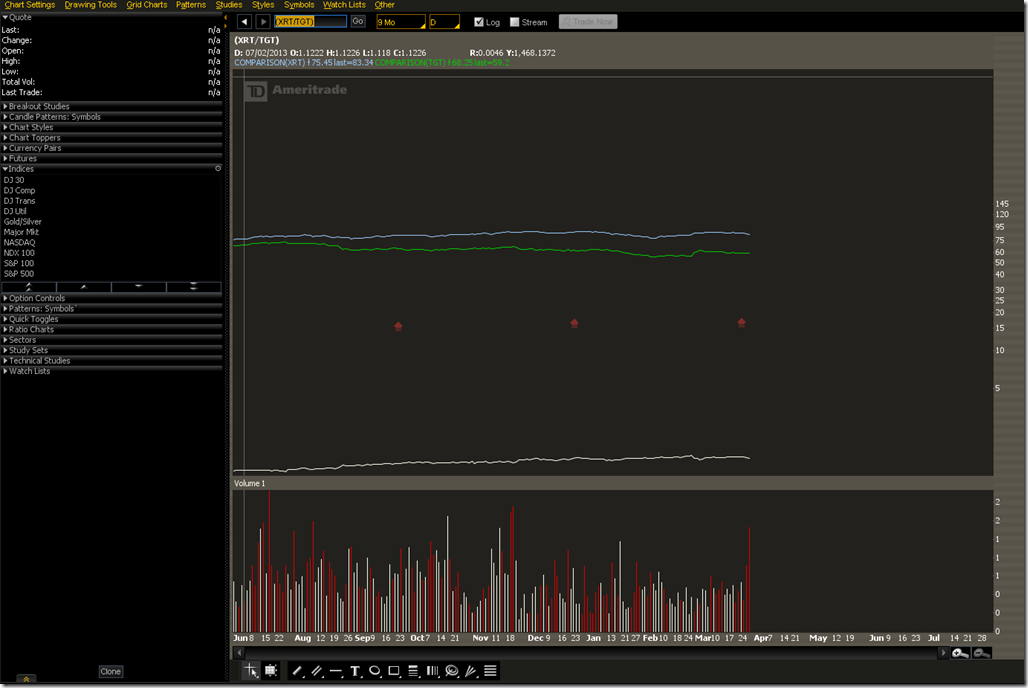

First we will compare Target (NYSE:TGT) (green line) to the SPDR Retail Sector ETF (NYSE:XRT) (blue line) so we can see the huge divergence between the retail sector as a whole and how poorly TGT has done since the hack. The first thing we notice is that TGT has under performed the bucket of other stocks that make up the retail sector. When picking single stocks vs. a broad ETF that is bound to happen. Next we notice that the ups and downs are about the same. This tells us that there’s no major comparative difference to the stock price during the time period when the breach was announced in September.

Next we’ll take a look at TGT during the December shopping season. Everyone in the infosec community jumped on the bandwagon that their sales were off because of the breach. Just look at that drop! It was obviously caused by the hackers, right?

Wal-Mart (NYSE:WMT) must have the same problem if we look at December – January.

When we dig into XRT for the same time period we see an almost identical wave pattern. What this suggests is that everybody in retail had a rough winter, not just TGT.

The weather is why the entire retail sector is down. Well, every sector is down because of the weather. That’s the trendy thing that CEOs are blaming the bad Q4 and Q1 results on. Unless the hackers have a bot net that can control the weather we can attribute TGT and everyone else’s ills to the Polar Vortex.

The other thing that we need to consider that huge gap up when TGT announced earnings. That’s a 7% move in a single day. They posted 81 cents per share profit vs. 79 cents consensus. Revenue came in at $21.5B vs. consensus of $21.45B. In other words, Wall St. already accounted for the potential downside and priced it in. The impact was rather minor considering that they had incurred $61M in expenses but were covered by a $44M insurance policy for a net loss due to the breach of $17M. Yes, the impact is minor. We can tell this since the IV% in TGT is currently 25% while the IV% of XRT is 51%. There is a lot more concern over downside in the retail sector as a whole than there is in TGT.

Will consumer behavior change as a result of incidents like this? Unlikely. TGT made a brilliant move by having the We’re Sorry Save 10% This Saturday Sale the week of the breach. Many savvy consumers went shopping, your Dearest Leader included. Who can say no to a 10% off sale? Everyone I know walked away with a deal and no stolen numbers. Taking a gamble to get a deal is what you have to do. You have to buy in before they do. You have to buy the dip.

The thing security professionals and the writers at all the trade publications need to understand about consumer behavior is a sale is something that everyone in a bad economy will chase after. Most people have more than one credit card. They can always use a different card until a replacement arrives if the numbers are compromised. Consumers are not legally responsible for the bill if fraud does occur. That makes it the bank’s problem, and most people don’t care about the banks since that mess some of them caused with the housing market. What exactly is the tragedy that all of the industry publications are writing about? Either way the breach is the least of the bank’s worries, especially if your name is Citi.

Once again we have another data breach that causes a company to beat EPS, while life for everyone goes on. There is some economic impact, but it’s spread among insurance companies, card processors, issuing banks and retailers. The risk is shared among the sellers and the buyers have no risk at all. Everyone on Wall St. knows that these kind of incidents are nothing compared to disasters such as the Polar Vortex or a large oil spill in the Gulf of Mexico. Until the magnitude gets to be that large these events will be a nuisance rather than a disaster.

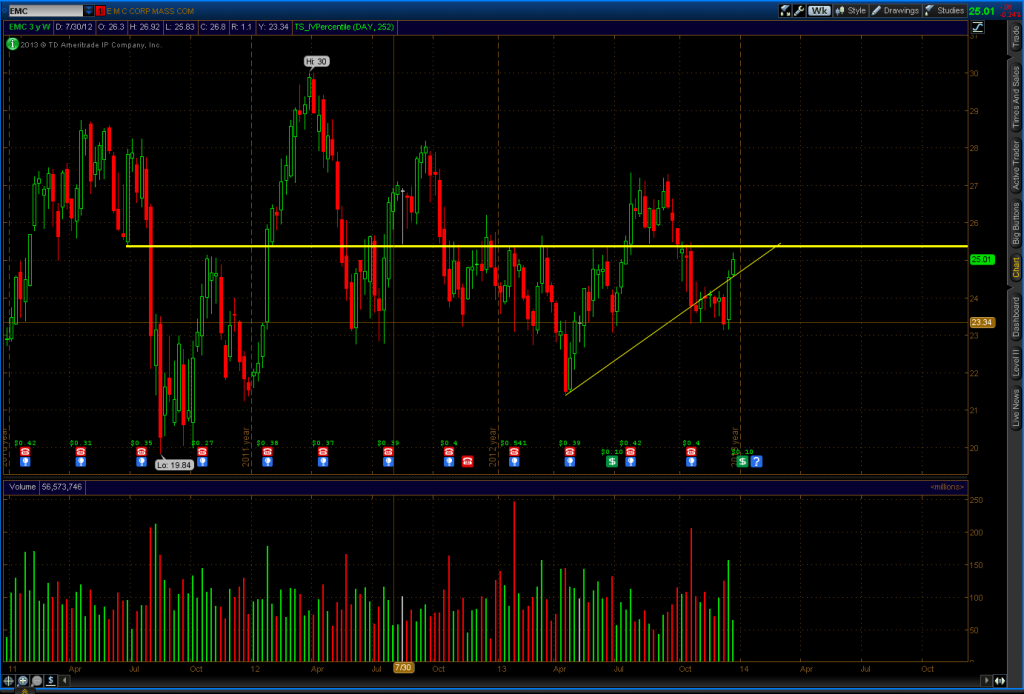

Where Does EMC Go After NSA Revelations

EMC seems to have quite a problem on its hands now that rumors have circulated that their RSA division has been accepting payoff from the NSA. We have seen shareholder lawsuits against IBM for not disclosing business risks involved with losing business internationally as a result of working with the NSA. Related risks for EMC include failure to disclose NSA involvement to shareholders in their regular SEC filings, loss of business internationally and domestically from the customer backlash, and regular reaming from the security community at conferences and other venues.

The weekly chart of EMC shows support/resistance below 26. A play in the direction of the break down/out could be available. This is a wait and see trade where we need confirmation before entering.

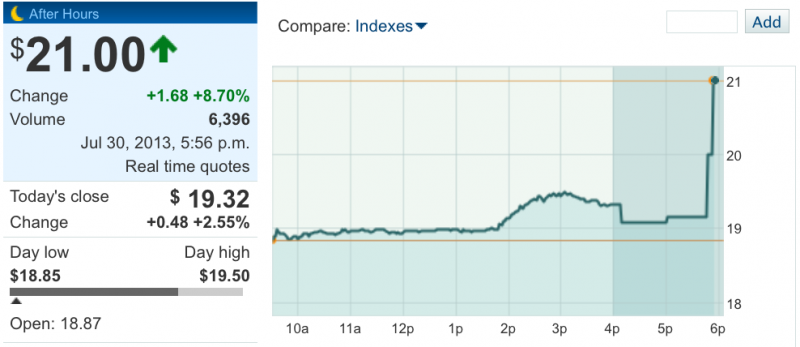

TGT Loses Payment Card Info Resulting In A Dip

After the breaking news over at KrebsOnSecurity that Target (NYSE:TGT) has been impacted by a payment card breach it is time once again to look for a dip to buy. The low point at approximately $61 matches up with some decent support and resistance levels from 1Q13. TGT is riskier than other sectors due to the retail environment at this time of year. Any attempt to buy the dip should be done close to $61 with a very tight stop. Any general bad news from the retail sector could blow this trade up. Low trading volumes from the financial industry taking vacation could also cause large price swings in either direction. Short Put Verticals are not the best for this, though an ATM Long Call Vertical will give about 50/50 odds over the next week.

Update: We decided to go with a weekly 62/63 Long Call Vertical. Closing out one day before expiration gets about a net 18.00 per contract.

NZD JPY Trade

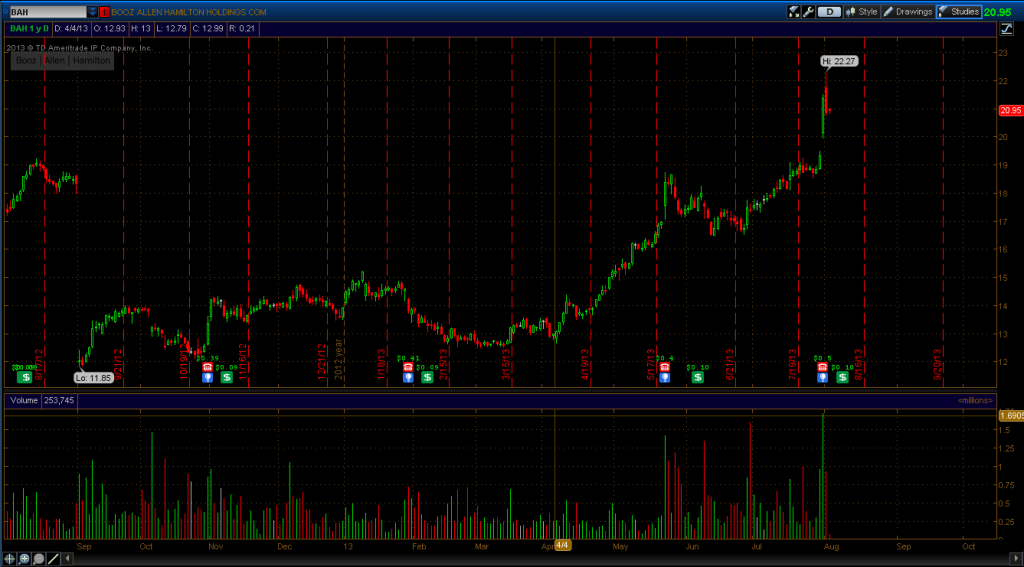

Booz Allen Still A Good Investment

Accenture is interested in buying Booz & Co., a spin out from Booz Allen Hamilton. Someone became a little jumpy and decided to buy shares of Booz Allen Hamilton thinking they were getting access to Booz & Co. For a company that has leaks there is enough interest to continue our hypothesis that hacking or leaking does not value of a company.

Leaking Data Does Not Hurt Value

At first glance it looked like $BAH would never get another government contract. But now $BAH is up 30% from when it was revealed that Edward Snowden worked for them. They are unlikely to be “leaked out of business” by Snowden’s actions. This adds to the historical evidence that companies do not go out of business if IP is leaked or stolen. It appears that the cliche of any publicity is good publicity is at work.

Are You an Acqui-Hire?

There has been some criticism of Yahoo’s acqui-hire strategy. There are those who believe that it clearly sends the wrong message to existing staff. Rather than work for a meager salary, one should simply quit to become part of the acqui-hire bandwagon. Yes, that is clearly the advice that staff should follow for the right reasons.

Contingent workers are becoming the norm in the US. It is estimated that 50% of the workforce will be contingent workers by 2020. The trend is that there will be fewer full time employees and most workers will be self-employed and have multiple clients to make a full week. Workers have nothing to lose by going out on their own and potentially a lot to gain. Will everyone win the lottery by selling their company? Of course not, but we should look at business ownership for what it is.

When a startup is acqui-hired, there are assets other than the people that are transferred. These assets could be servers, and patents among other things. The buyer is getting a complete company as part of the deal. The technology may be integrated into the buyer’s offerings or it may simply be shut down. In the latter case it is clear that the acqui-hire was purely for the talent and not the technology; however, the assets still have value and can remain on the buyer’s balance sheet continuing to add value.

A commodity small business such as book keeping or project management is less likely to have patents, lots of source code, and tons of servers. That does not diminish the value of what they have to offer. The value of the owner’s investment is different, but not less. Most small businesses will not have an early exit strategy. Instead they become lifestyle businesses that will maintain the founder for many years.

When starting a small business, the founder must consider what the exit strategy (if any) will be. A business is a form of investment in terms of time and capital. Since a business is an investment we should consider the various types of investments in one’s time to illustrate the various value propositions.

- Employee – employees can be seen as investment-grade bonds. Investment-grade such as high rated corporate or certain government bonds are considered a safe investment for the long-term. They tend to pay very little interest, but it is unlikely that the investor will lose their capital. Working at a traditional day job is a low risk opportunity because the employee has little to no capital invested in the business.

- Commodity Business Owner – this class of worker represents the next and most common step in entrepreneurship. They can be seen as high yield bonds. High yield bonds do pay more, but they have a higher probability of losing money. This represents the higher professional rate that a commodity business owner can charge. The downside is there is volatility risk such as lack of steady work that the Employee (investment grade bond) does not face. There is also the possibility that the investment in the high yield bonds could be worth less than the initial investment. This would occur where the business fails and is worth cents on the dollar in liquidation when the owner shuts down.

- Acqui-Hire Business Owner – the acqui-hire business owner invests time and energy with the expectation that the sale of valuation will increase in the future. The acqui-hire is like an equity investment. The value is based on the appreciation of the asset and the expectation that someone will pay more in the future than the previous investor.

Most entrepreneurs will set out to be the commodity business owner. While it does not have the safety and routine of being an employee, it does have the potential to be a medium to long term investment in one’s time and energy. In the world of bonds this is referred to as the hunt for yield. All things being equal, an investor will sell a bond and replace it in a portfolio with a bond that pays a higher yield. A commodity business owner will replace lower paying customers with higher-paying customers. It does lack the excitement of being an acqui-hire, which is the equivalent of seeing a stock portfolio double, triple, or more. On the other hand it can be the best of both worlds in terms of having an easy to manage investment strategy.

Leaking Is Not As Bad As Hacking

Booz Allen Hamilton (BAH) is getting slammed according to Business Insider. BAH was down 5% at most according to some news outlets. Buyers quickly stepped in and propped up the stock and it’s hovering at around -3.5% on the day.

BAH has lost 5% while EMC and Lockheed lost 10% before buyers stepped in. We can conclude that leaking is only half as bad as being hacked. This should be a lesson to all Public Relations teams. Use the term leak, not data breach.