EMC seems to have quite a problem on its hands now that rumors have circulated that their RSA division has been accepting payoff from the NSA. We have seen shareholder lawsuits against IBM for not disclosing business risks involved with losing business internationally as a result of working with the NSA. Related risks for EMC include failure to disclose NSA involvement to shareholders in their regular SEC filings, loss of business internationally and domestically from the customer backlash, and regular reaming from the security community at conferences and other venues.

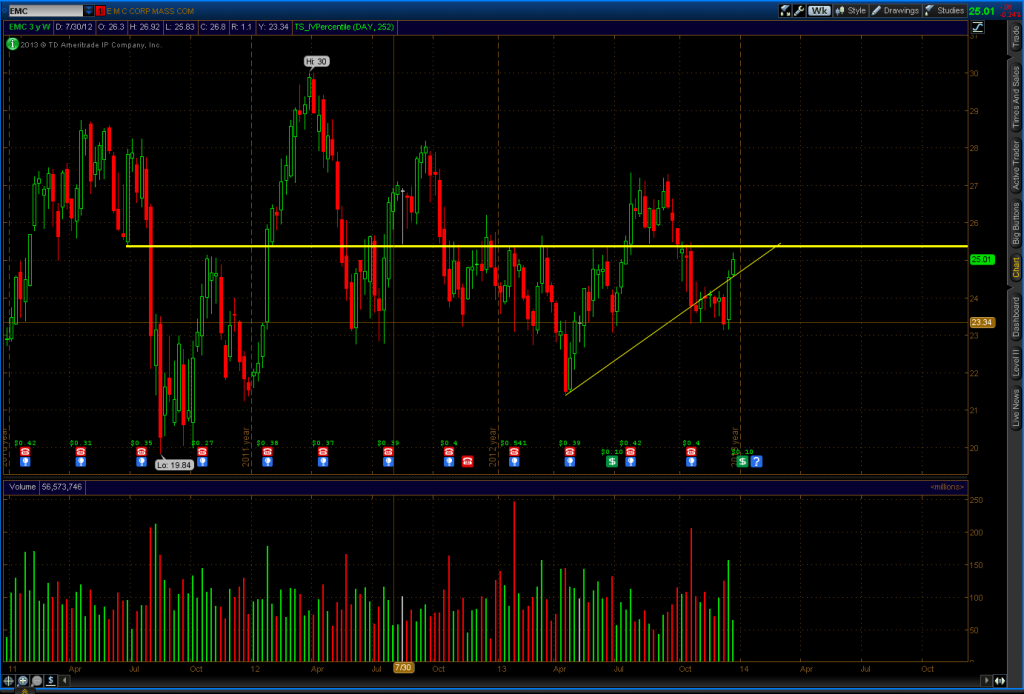

The weekly chart of EMC shows support/resistance below 26. A play in the direction of the break down/out could be available. This is a wait and see trade where we need confirmation before entering.