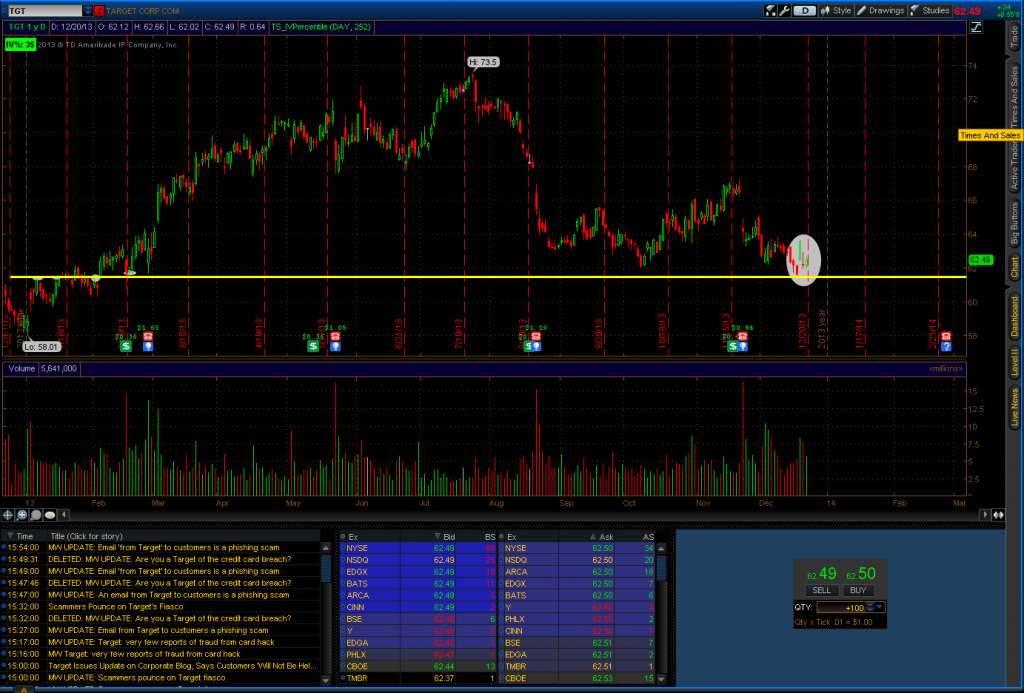

After the breaking news over at KrebsOnSecurity that Target (NYSE:TGT) has been impacted by a payment card breach it is time once again to look for a dip to buy. The low point at approximately $61 matches up with some decent support and resistance levels from 1Q13. TGT is riskier than other sectors due to the retail environment at this time of year. Any attempt to buy the dip should be done close to $61 with a very tight stop. Any general bad news from the retail sector could blow this trade up. Low trading volumes from the financial industry taking vacation could also cause large price swings in either direction. Short Put Verticals are not the best for this, though an ATM Long Call Vertical will give about 50/50 odds over the next week.

Update: We decided to go with a weekly 62/63 Long Call Vertical. Closing out one day before expiration gets about a net 18.00 per contract.