Sony was upgraded by Moody’s to investment grade (Baa3). CDS costs have dropped showing confidence in the company and its turnaround plan. No mention was made of the alleged breach by North Korea which means it left the minds of investors long ago.

Tag: business

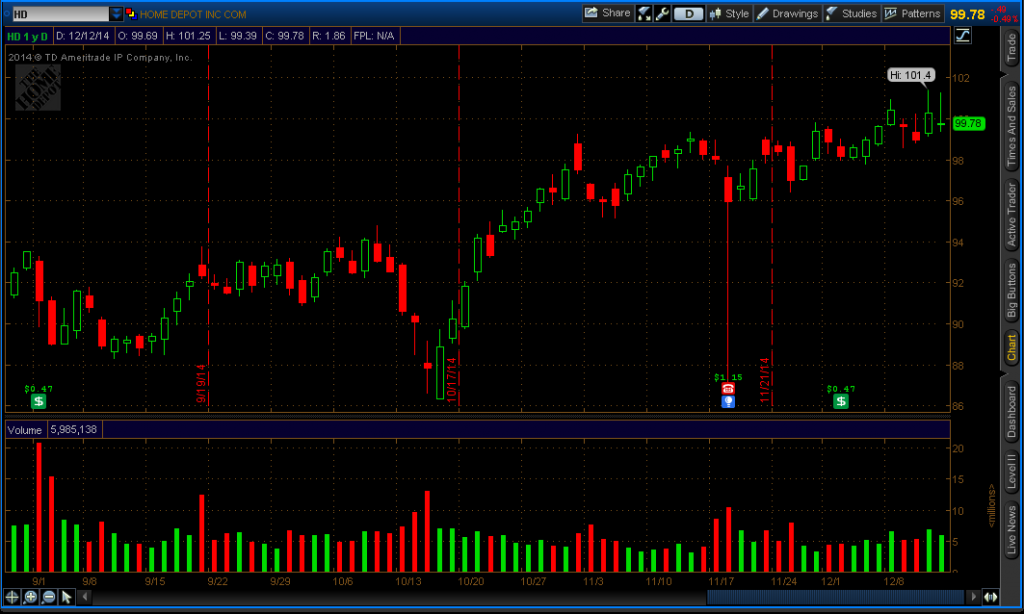

Home Depot earnings indicate there is no fear

Home Depot (NYSE: HD) continues to grow with consumer fears of the data breach well behind us. Consumer behavior continues to demonstrate that the public is not bothered by these events. Earnings and the stock price continue to rise after the breach which goes against the conventional wisdom in Infosec that customers will leave after a breach and that there will be a stock sell off as a result.

If we expect customers to disappear sales should be down, not up. We have to consider the reality of the retail situation. Not everyone is near a Lowe’s (NYSE: LOW) or Ace Hardware. $HD is the only game in town for most shoppers. Even if alternatives are in your area, would you drive out of your way to avoid shopping at $HD? Consumer behavior is driven by price and convenience, not the fear of hackers taking their credit card numbers. Under the Fair Credit Billing Act (FCBA) consumer liability is limited to $50 for fraud. Who is going to drive out of their way for a maximum of $50 in risk? Also consider most credit card companies will eat that $50 due to price matching competition with other issuers. Consumer risk is effectively $0.

The numbers speak for themselves. The latest earnings release from $HD shows that this fiscal quarter the number of customer transactions is up by 3.2%(355.4M) , with an annual increase of 3.3% (344.3M). Net sales are up 5.4% ($20,516M) with EBITDA up 5.7% ($7,185M) . EPS was $1.15 per share. Online sales are up 40% for the quarter and up 50% vs FY13Q3.

The earnings transcript is also quite interesting. The term “security” is only brought up once in the opening remarks.

Before I close, I’d like to briefly comment on the data breach. First, we apologize to anyone impacted by this. From the start, our guiding principle has been to put our customers first. Our customers won’t be responsible for any fraudulent charges incurred through the breach and we will continue to offer free credit monitoring and ID theft protection to any impacted customers. We will continue to invest and enhance security measures to protect our customers’ information.

The statements from Carol Tome, CFO are also interesting in that the breach cost less than $TGT. Also consider that all of this is going to go away due to their insurance policy.

In the third quarter, as a percent of sales, total operating expenses decreased by 56 basis points to 22.6%. Our third-quarter expenses included $28 million of net expenses incurred as part of our data breach. We carry a $100 million insurance policy for breach-related expenses. The gross amount of breach-related expenses incurred in the quarter was approximately $43 million. For the fourth quarter, we are projecting our known gross breach-related costs to be approximately $27 million and after insurance, a fourth-quarter net breach expense of approximately $6 million. For fiscal 2014, given our projected known net breach-related expenses of $34 million, we now expect fiscal 2014 operating expenses to grow at approximately 27% of our sales growth rate

The breach was $28M net. Considering that their sales for the quarter are $20.514B you’re looking at $.028B in net expenses from the breach. There’s a term for that. It’s called a rounding error.

Questions from Wall Street also curiously point to no real effect. JPMorgan (NYSE:JPM) notes that sales slowed in September and then took off in October. The CFO predicts things will go to the upside as nobody on the call says stores are reporting any customer blowback from the breach.

Chris Horvers – JPMorgan Chase – Analyst

Thanks. Good morning, everybody. A couple questions. So can you talk about whether you’ve seen or you saw any impact from the credit breach? What did you hear from stores? What was the pro saying in September, October? September trends did decelerate and then reaccelerate pretty nicely in October. So was curious if you thought any of that was the breach and what you are hearing in the field around it?Craig Menear – The Home Depot, Inc. – President & CEO

Chris, really it’s very difficult for us to be able to determine if there was any impact. We were very, very pleased with the fact that we had positive transaction growth in each month during the quarter. And I think that represents strength for our customers, confidence in The Home Depot and we appreciate that.

Carol Tomé – The Home Depot, Inc. – EVP, Corporate Services & CFO

And don’t mean this to sound defensive, but if you look at a three-year stack, September was our hardest comparison.Chris Horvers – JPMorgan Chase – Analyst

Understood. Right. Okay. And no real like, I guess, your stores aren’t communicating anything up to you that’s conclusive in either direction?Craig Menear – The Home Depot, Inc. – President & CEO

No.Chris Horvers – JPMorgan Chase – Analyst

Okay. And then as a follow-up, Carol, curious if you could talk about your thoughts on November. Of course, you said nothing has come to your attention, but you’ve heard a lot of retailers speak to a pickup or at least as good as sort of the trend from 3Q. So was curious how you would describe your view of November.Carol Tomé – The Home Depot, Inc. – EVP, Corporate Services & CFO

Happy to talk about our perspective on November in the fourth quarter. As you know, it’s always tricky to forecast where sales will go in the fourth quarter because we’re heading into winter and I don’t know about where you are, Chris, but it’s mighty cold here in Atlanta. That being said, we are two weeks into November and I must say that I’m impressed with the sales that we’ve reported to date. So if there’s a bias in our forecast, I would say the bias is to the upside.Chris Horvers – JPMorgan Chase – Analyst

Thanks very much. We like the word impressed. Good luck in the fourth quarter. Thanks, guys.

The stock is up about 10% since the breach. You don’t want to be on the wrong side of the trade like this person. Evidence suggests you never short a breach. You will be destroyed. You have to buy in before anyone else does. You have to buy the dip.

$HD: shorted this bad boy at $90 and have been destroyed. skyhigh expectations being dashed are my only hope for redemption

— tryingtomakeabuckinthemarket (@contrarianspeculator) Dec. 13 at 12:32 PM

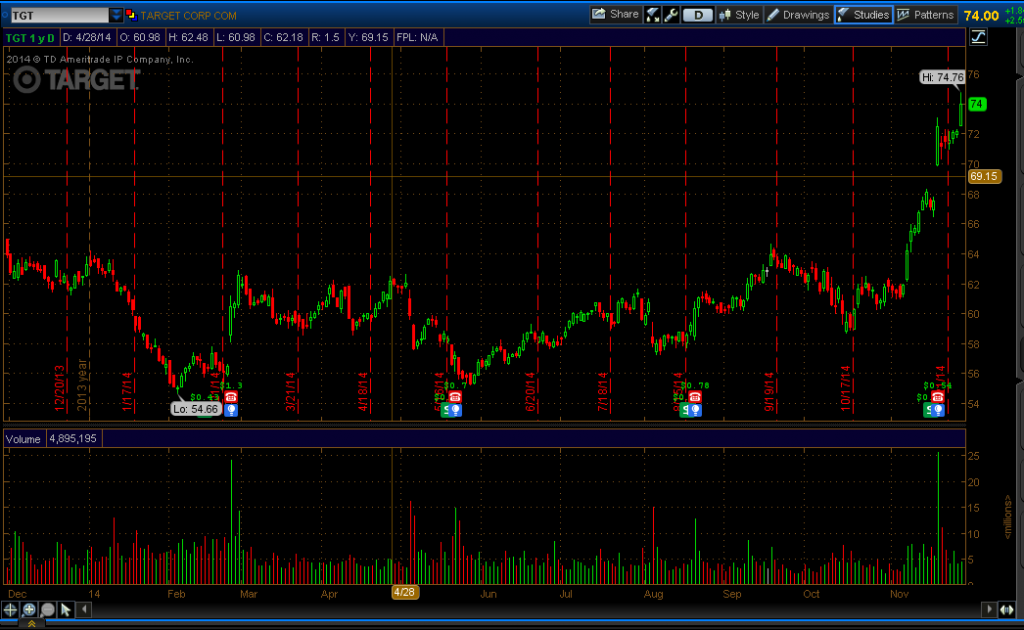

Target Continues to Conquer All

Black Friday is back and the retail sector is better this year. According to reports Target (NYSE: TGT) sales figures are up 40% over last year. Consumers really did not care about the hacking last year, and this continues to prove that such events are largely forgotten and do not influence consumer behavior.

As we can see investor confidence is higher than last year. TGT is now above the resistance of 73.50 from 7/22/2013 on the weekly chart. We are likely to see a continuation if the new support level holds.

The Coming Financial Insurance Infosec Polar Vortex Storm Cloud

Twitter (NYSE: TWTR) is such an amazing tool for communicating and sharing ideas. @Wh1t3Rabbit @DFIR_Janitor @_sw17ch and I had some discussions regarding a topic that I have been discussing with @chriscarpinello for some time. The great topic of Cyberinsurance! The most recent article to kick off a lively discussion was published by ZDNet: Police can’t stop cybercriminals, but maybe insurers can. Which led to some great commentary by @_sw17ch at Misguided Security and @DIFR_Janitor at CyberGuardians had some great commentary about the content of the article and where it’s going.

The general consensus from the infosec crowd is that this is going the wrong way if government is powerless to fight cybercrime, but insurers (part of the financial industry) can. This is absolutely no surprise to me at all. @alessiorastani told us this fact in 2011 when he went on BBC and said “Governments don’t rule the world. Goldman Sachs rules the world.”

Now that we know who is really in charge that should tell everyone to put down the Metasploit, and become Bankers.

I have been saying for a long time that the future of Infosec is in insurance. There have been many events in the past year where large companies experience an incident and the brunt of the impact is taken away by insurance. If JPMorgan (NYSE: JPM) can’t stop bad things from happening with 1000 people and an operating budget of $250M, what chance does a small business have?

@schunk says it well here

@_sw17ch @Wh1t3Rabbit @dearestleader I work for an insurance company, key factor is big business understands insurance more than #infosec

— Ron Parker (@scmunk) November 18, 2014

That is a great point as @scmunk goes on to say insurance has been around longer so people understand it more. How many people have elderly relatives who don’t know how to operate the DVR (or VCR when they had one)? For infosec professionals this stuff is very simple, but we all have to consider that we are from different backgrounds. We are the DVR stuck on repeat while the people around us are more concerned with how to operate the remote than watch what’s on the screen! This is a lot like patent law. The obviousness test is dependent on who is looking at the subject.

At the end of the day everybody’s job is help their business remain profitable. That goes for commercial and not-for-profit entities. The first objective everyone should have is to defend the balance sheet and income statement. When Something Bad Happens (TM), insurance is a tool that can help you with with your defense.

Let’s look at an incident, and it doesn’t matter if it’s a lawsuit for food poisoning, a factory burning down, or a group of APT Hackers. This is just like day trading stock. You don’t need to know what the company does, its financial situation, or its outlook for the future. There is some set of information that lets you move on to the next step without consideration for what else is happening.

You have some probability that something will happen and the cost of when it does. Sound anything like your CISSP exam? Let’s focus on the cost. When something breaks you have to pay to fix it. This adds to your Operating Expenses on the Income Statement, resulting in lower Earnings Before Interest and Taxes (EBIT). Insurance covers your out of pocket expenses and restores those assets. Yes, but it doesn’t replace lost revenue you say? It can if you buy the right product. You can get additions to your business continuity policy that not only replace your factory, but also will pay you revenue based on your last quarter’s earnings until your factory is rebuilt. It’s like the Servco slogan, as if it never happened.

If we take a high level view of All The Bad Things That Could Happen(TM), management will first be concerned with what happens to the Income Statement and Balance Sheet. There will be lots of insurance policies for different events in place. Do we need to get caught up in the details of the probability of a forest fire this year or the odds of “Peggy” having a side job at USA Prime Credit stealing your data? Not really. Someone else is going to pay. All you need to do is make sure all of the policies cover every possible scenario. Then you can go spend money on those fancy Palo Alto (NYSE: PANW) NGFWs and some FireEye (NASDAQ: FEYE) to keep “Peggy” out.

That’s assuming that you ever get to spend money on….those wonderful toys. Remember how we discussed EBIT earlier? There’s another reason that is important. Most companies have debt. One thing that is important to the investors is the Debt-to-EBITDA (Earnings Before Interest Taxes Depreciation and Amortization) ratio. In simple terms this is expressed as your debt divided by the sum of the last four quarters EBITDA, evaluated on a quarterly basis. The desired ratio varies but usually anything over 4 is bad. In some cases if your Debt/EBITDA ratio exceeds a certain number you are considered in default which is bad. Even though everything at the company appears normal, your investors will consider exceeding the ratio spelled out in the Covenants the same as skipping out on the loan entirely. The entire balance comes due at once, credit ratings drop because you skipped out on the loan and continue not to pay the full balance, the CFO gets fired for letting it happen, and people get laid off. The other complication with Covenants is that your investors can dictate what you spend your money on by limiting your CapEx and OpEx expenditures. They may not see the value in those Palo Alto firewalls or something to keep Peggy in line. If you thought arguing your case with the C-Suite was hard, just try talking to some investors representatives that are interested in making sure you keep your Debt/EBITDA low by controlling CapEx and OpEx, so they have assurance you’ll have enough money to keep paying them back. Their only risk is credit risk and you answer to them first. Your operational risks are not their concern. Besides, they bought insurance on the loans in case you go out of business so they can get their loan principal back.

Now let’s look at the effect on EBIT. If you spend $250M on security equipment and 1000 people, you could still have a cyberincident which means you’re paying out in investigative fees, regulatory penalties, notification letters, etc. Spending that $250M increased your operating expenses, thereby reducing your EBIT, potentially getting you into trouble with your investors. Now you have an incident, which drives up expenses even more, reducing your EBIT, which gets you into trouble with your investors. What we learned from the JPM breach is that even if you spend that kind of money, something will happen eventually, whether it’s Peggy or a forest fire. If you’re really short on cash, buy breach notification insurance. Having that can make or break o small business or non-profit. Buy a mid-size insurance policy for more protection. You might be like Target and have most of your cyber incident covered. Buy a huge policy that covers everything including replacement of revenue and it will be as if it never happened. Then you can balance the CapEx cost of security equipment and the OpEx cost of people to operate that equipment vs. any savings in insurance premium you get for having a security program. Juggling this is all can do if you’re a small business. Even if you’re a large business it might pay off to cut your security expenditures a bit and increase your insurance coverage.

Where do we take it from here? If you read into what I have written there are many learning and career opportunities here that will add to your marketability or you may decided, as I have, to move on to something other than technology based infosec. Here are some quick takeaways.

Learn to speak the language of the CFO and their team. My Finance I professor said, personal finance and corporate finance are exactly the same. The only difference is the number of 0’s. You can put the same concepts to use in your personal life in addition to work.

Take a free online course in Management Accounting. That’s not Quickbooks. It’s using accounting information and relating it to business decisions. If Bob sells a burger meal for $10 and his cost is $9, and he needs to sell 300 meals a day should he run a 5% off coupon? No because if he has trouble selling 300 meals, he’s going have even bigger problems selling 600 to make the same money for a measly .50 off. Think of how demanding discounts from your suppliers or purchasing alternative equipment affects the financial outcome of what you do (EBIT). Your CFO will thank you.

Take some free courses in LEAN or go for a LEAN Six-Sigma Black Belt. If you have Covenants that restrict your spending, the best way to remedy that is to help cut costs, reengineer processes, eliminate waste. Convince your CFO to let your department keep a portion of the savings you “find” (in other people’s departments of course). At the very least improving EBIT reduces your credit risk, and improves the company’s general survival rate. At best you end up with more budget. In all cases, if you’re known as “the cutter” to the finance department, you’re not likely to end up on the layoff list when things do go south.

Talk to your corporate Treasurer. Treasury manages daily cash flows. When Bad Things Happen(TM) Treasury has compensate for expenses such as those PCI auditors who are going to give you a beating. Treasury also usually handles all of the company’s insurance policies since that protects the cash they manage from Bad Things (TM). That Management Accounting class you took will come in handy when both of you sit down and play with the variables on the insurance company’s questionnaire. Do we buy that control? How much of a premium discount do we get? Nope, we spend more on the control than we get back on the premium.

Consider taking your state’s insurance licensing exam. In my state Errors & Omissions (aka E&O or Professional Liability) is covered by the Property & Casualty License. Cyberinsurance, business continuity, and injury should be part of this license. If you’re at a small or medium sized company more than likely you’ll be the only one who knows this topic inside and out. Your Compliance Department’s Conflict of Interest (COI) policy might prohibit you from selling to your company, but you will get experience with the language by selling to other companies as a side hustle. You’ll be an asset by learning to read the fine print and pointing out where your agent/broker left loopholes in the coverage. If you take on the insurance role at your company, guess what? You’re now performing a Treasury role and you’re a Financial Professional! After a few years of handling insurance you can take the Certified Treasury Professional exam. How many people have a CISSP, CTP, and an insurance license? That’s exclusivity you can charge extra for! There are also a lot of great nonprofits out there that could use an insurance agent/broker who will give up a little in commission to help them get a good deal on a policy.

Talk to Compliance and Legal to find the minimum spend on regulatory and legislative matters so your organization doesn’t appear negligent. Assisting with the paralegal research will help you understand all the different regulations, the associated penalties, and the highlights of cases such as FTC v. EVERYBODY. This builds on your Management Accounting class. Work with Treasury to come up with a properly sized policy for regulatory fines (yes there is a policy specifically for that), and balancing the outcome to arrive at EBIT your CFO will appreciate. Who knows, after hanging out with Compliance for a while you might pick up an interest in what we do outside of infosec, such as Anti-Bribery Anti-Corruption (ABAC), Child Labor, Ethics, Sustainability, and Conflict Minerals. Truth be told, those things are why I switched to Compliance because they mess up our world and who we are more than Peggy ever could. You can find more about becoming a Compliance & Ethics Professional here.

Keep an open mind in your journey. As we learned early in our technical careers, you use the right tool for the job. We also learned when we were young, when you have a hammer everything looks like a nail. Information Security doesn’t have to be accomplished with IT Security because Peggy is using a computer to hack you. We can use many different skills and resources to make it as if Peggy never happened.

Correlation Between Hackers and Target Stock Performance

Every retail CEO is blaming the weather for the poor sales. We all know that Target (NYSE:TGT) had a bad holiday because of hackers and not the weather, right? Well now Wal-Mart (NYSE:WMT) blew up their numbers and they’re saying it was the weather too. How is this possible? Obviously the hackers must have scared everyone away from Wal-Mart as well. There is absolutely no way it could be the Polar Vortex, right?

What if there is some connection between hackers and the weather? If we look at recent happenings in San Francisco, we can see that the street signs have been hacked saying San Francisco is closed because it’s too damn hot. It is obvious that hackers like cold weather. We should have seen this before since they invaded Target through a HVAC company. This is all the proof we need to know that the hackers were behind the poor earnings at Target because they made off with the credit card numbers and created the Polar Vortex. This blows up our previous study of data because we weren’t counting on hackers being able to control the weather.

We have absolutely tied hackers to the destruction of the entire retail sector. If hackers aren’t behind the Polar Vortex and poor retail performance then there is only one other possibility.

Emoji May Be The Language Of The Future In Business

Business Insider is covering the use of Emoji in communication. This is something that is sure to outrage Grammar Nazis and those who are proper language traditionalists. Rather than panic and wonder how the youth are going to make it, we should step back and think outside the box. We already have situations in business where proper English is not spoken. Go into any warehouse or assembly line staffed by immigrants and you will find less than perfect written and spoken English. Chinglish is also a term applied to products that have had poorly written translation software applied to make the translation from Mandarin to English. The translation may not be perfect, but we understand what the general meaning is.

A well known SciFi writer has created a world in the future where English and Mandarin are the official languages of the human race. What if that isn’t the case? What if a new abbreviated language such as the one teenagers use for texting is the unified language of the world? What if we become like the Ancient Egyptians and move to a hieroglyphic language to be all inclusive? This is where emoji may fit in. The old view of business is dying out as the Baby Boomers retire from the workforce. There are many VP’s today who don’t perform drug testing because it’s outdated and it takes away from the bottom line. There are also many people in GenX and GenY who will hire subject matter experts, no matter what their fluency in English is. If we can communicate in the made up language of Chinglish, why not communicate using other ways? The only thing holding us back is an outdated mentality of thinking something has to be done a certain way, rather than something has to be done.

Refusing To Hire Black Hats May Be Risky And Costly

The topic of hiring reformed Black Hats continues to be a matter of debate. Some believe that ‘You’re shooting yourself in the foot if you’re not willing to hire a hacker’ while others believe such an idea is preposterous because it is not possible to reform any person who has been convicted. Others may believe it simply doesn’t look good to hire convicted felons and dismiss the thought. Unfortunately it isn’t possible to do that in the US and the continuing attitude toward convicted felons must change.

On April 25, 2012 the Equal Employment Opportunity Commission (EEOC) released new enforcement guidance regarding the Consideration of Arrest and Conviction Records In Employment Decisions. In summary the enforcement guidance prohibits blanket policies that prohibit hiring convicted felons. Security professionals should speak to HR, Legal, and other stakeholders to determine the proper processes for applicants. If two candidates with similar qualifications apply, an employer can not simply choose to not hire the felon.

Employers must now take a variety of factors into consideration such as age at time of conviction, employment history, number of offenses for which there is a conviction, rehabilitation efforts, and other criteria. This creates a layer of complexity in screening applicants. Businesses are starting to reconsider the importance, and more importantly, the liability associated with pre-employment background screening. Risk averse organizations may choose to forego criminal background screening since one defense against a discrimination claim is that the applicant’s background was never checked. The risk of an applicant alleging discrimination is also why many legal and compliance professionals recommend against social media reviews. If you do not know an applicant’s religious or other affiliation, it is easier to defend against a discrimination claim.

One aspect to consider is whether or not the candidate is a good fit for the organization. Personality and demonstrable skills are becoming more important than degrees and other factors. Should we consider arrest and conviction history among those other factors? Security professionals are conditioned to believe that everyone must be squeaky clean. In terms of stakeholder management this attitude does not always bring shareholder value and may be at odds with the strategic direction of the business.

The organization’s Corporate Social Responsibility (CSR) policy or Compliance & Ethics Program may require that the organization hire convicted felons as a means of helping them rejoin society. Such policies can also help reduce recidivism. The CFO may also become involved in the discussion as well. The US Department Of Labor Work Opportunity Tax Credit can save the company $1600-$9600 depending on the employee hired. Maximizing tax efficiency is one thing that finance and accounting professionals do. There can be a financial case for hiring convicted felons, especially in the information security discipline.

The topic of hiring reformed Black Hats is controversial, but when the complex legal requirements are considered the possibility of government sanctions make the idea of hiring Black Hats worth considering. Information Security professionals can take part in the strategic direction of an organization by working with HR, Compliance & Ethics, and Finance to enhance the organization’s overall goals. We have attempted to end discrimination based on a person’s skin color. The color of the hat they wear is something we should also add to the list.

“It doesn’t matter whether it’s a white cat or a black, I think; a cat that catches mice is a good cat.” — Comrade Deng Xiaoping

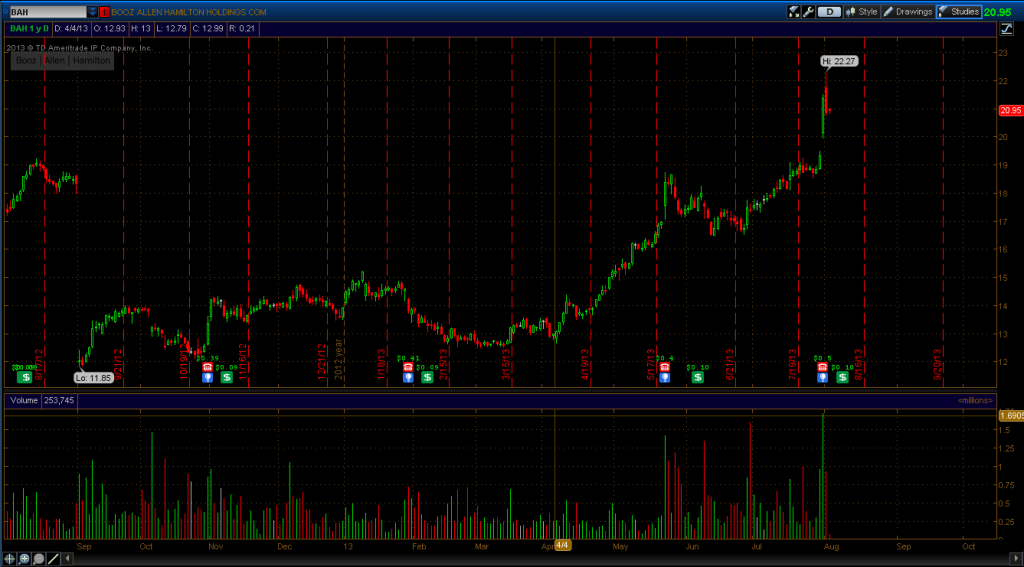

Booz Allen Still A Good Investment

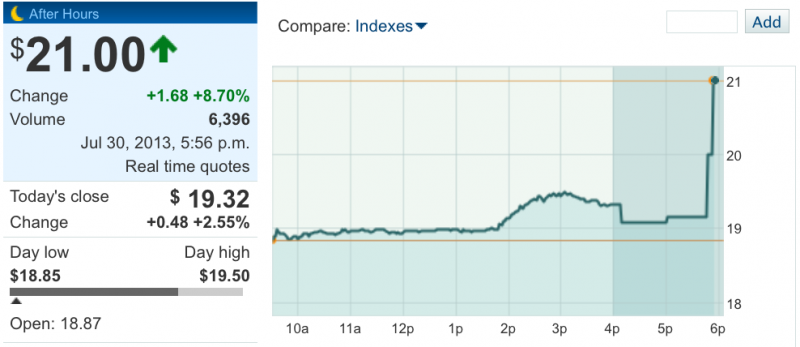

Accenture is interested in buying Booz & Co., a spin out from Booz Allen Hamilton. Someone became a little jumpy and decided to buy shares of Booz Allen Hamilton thinking they were getting access to Booz & Co. For a company that has leaks there is enough interest to continue our hypothesis that hacking or leaking does not value of a company.

Leaking Data Does Not Hurt Value

At first glance it looked like $BAH would never get another government contract. But now $BAH is up 30% from when it was revealed that Edward Snowden worked for them. They are unlikely to be “leaked out of business” by Snowden’s actions. This adds to the historical evidence that companies do not go out of business if IP is leaked or stolen. It appears that the cliche of any publicity is good publicity is at work.

Improve Security and Efficiency By Going Cloud

Microsoft’s cloud trust study indicates cloud security is a matter of perception. A recent Trustworthy Computing survey indicates that small businesses that try cloud services seem to appreciate what they have to offer. This is no surprise since they are in business to make money, not manage infrastructure. Outsourcing is an opportunity cost decision. In almost all cases the impact to the business cash flow statement will override any concerns regarding outsourcing vs. insourcing. Small business survival depends on the adoption of LEAN principles. Reducing waste reduces cost.

94 percent of SMBs have experienced security benefits in the cloud that they didn’t

previously have with their on-premises service, such as up-to-date systems, up-to date antivirus protection and spam email management.

91 percent of SMBs said the security of their organization had been positively impacted as a result of cloud adoption

Many non-technical SMBs without full time IT staff are going to experience benefit from cloud services. In order to get the full benefit of security monitoring, it has to be a dedicated 24/7 function. An 8-5 business that doesn’t generate revenue for the other 16 hours is sinking money in performing this function themselves. From a financial point of view it almost never make sense to ramp up a 24/7 IT shop in these circumstances.

While the survey discusses businesses with 25-499 PCs there is another demographic that cloud services can provide benefit to. Studies indicate that up to 50% of the US workforce will be self-employed by 2020. The group that stands to benefit most from cloud services is the 1-5 person company where everyone involved is an owner/operator and all other work is subcontracted. Cloud services make the most sense where the owners are the salespeople and unrelated people are subcontractors. It doesn’t matter if you’re selling IT services or office cleaning services, you are already taking on risk from subcontracting. Let’s pretend you are selling IT services and you find a few generic MCSE’s to do the hands on work that are 1099 contractors or B2B such as LLC to LLC. If your entire business is built around finding these freelancers to do the work, you are already outsourcing. What possible reason could you have for wanting to insource your IT infrastructure or personnel?

Security professionals that only look at security may survive in Enterprise IT. In SMBs every employee is not an IT professional, an accounting professional, etc. They are stakeholders. The ability to diversify your portfolio of skills, roles, and personality traits is what will make you a winning team member and a winning investor.