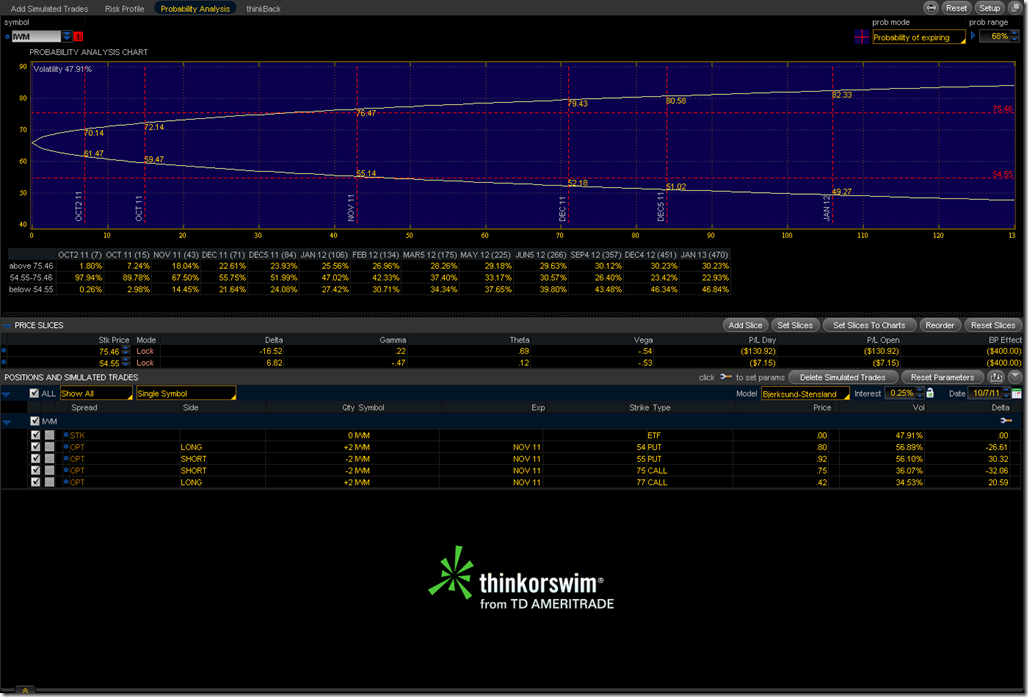

The market has been a little crazy lately and unless you’re scalping intraday it’s hard to find something that works well. What we’re testing out here is a very wide unbalanced Iron Condor on IWM. Below is a two year chart showing how wide this spread is. The lows were from November 2009 and there are several support levels that we must go through to reach our loss point. To the upside there is resistance at multiple levels starting in August with a recent head and shoulders pattern and multiple points in 2010. There’s a lot to go through before it reaches either side of the condor.

The Trade is to sell the 75/77 Call and the 55/54 Put. At this point we’re more worried about downside risk than upside, so the the downside is 1 strike wide with a max loss of 55 per contract. The upside is 2 strikes wide with a max loss of 155 per contract. This is something that depends mainly on Theta (time decay) so direction isn’t that important. If things start to move above the H&S to the upside some equity or call positions in TNA could be used to hedge. For the downside long equity or call positions in TZA can be a hedge. Based on things as they stand today this trade has a 70% chance of expiring between the two strikes. This is a relatively low risk position and offers opportunities to hedge risk to cover the max loss should the stock move that far.