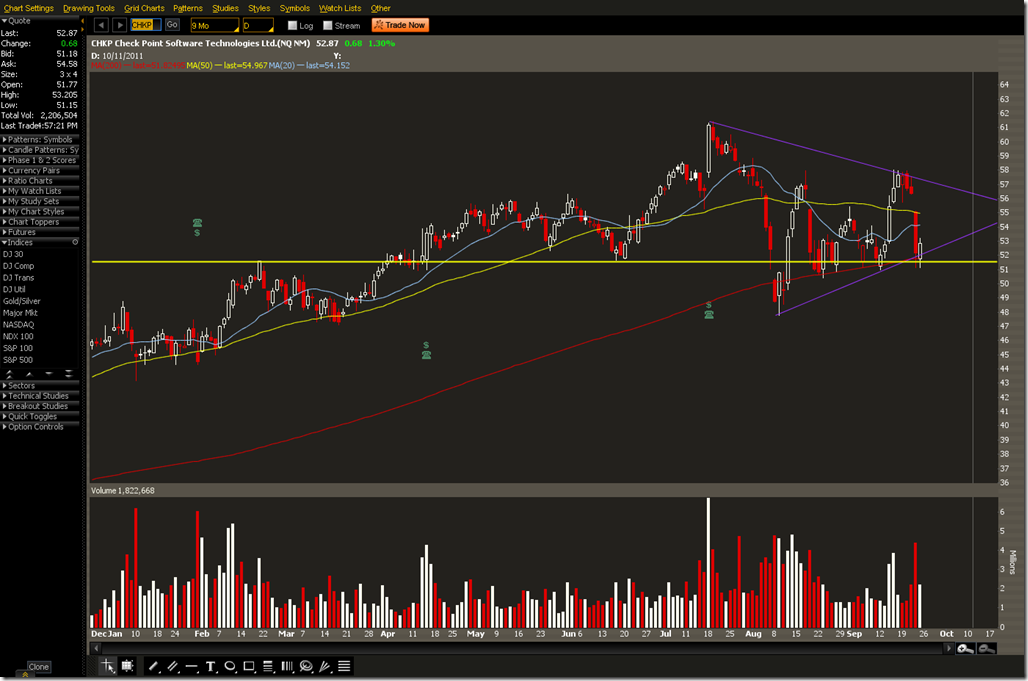

The well known maker of firewalls and other security solutions has a nice setup here. Prior resistance from February 18 held up as support at the 200 DMA. CHKP also closed back inside the trend line on the 23rd. Earnings is set for October 20 which would account for a big squeeze if the stock stays inside the triangle. The weekly trend is still up so this is likely to be a continuation.

Aside from playing long equity there are a few options here.

One is to sell an ATM Vertical option. This assumes that the 200MA, the February resistance, and the trend line will hold up. The 50MA was resistance on Thursday and that is relatively close to resistance on August 18 and also Near the end of April. Closing half a position close to the 50MA would be one way of reducing this exposure. This is the setup SELL -1 VERTICAL CHKP 100 OCT 11 52.5/50 PUT @.95 LMT

The other option is to bet on a break out after earnings on October 20. IV for October is 50% while November is 45%. A call calendar above the resistance at 58 could be one way to capture a break out. BUY +1 CALENDAR CHKP 100 NOV 11/OCT 11 60 CALL @.55 LMT

If we were looking to pin close to the center of the triangle BUY +1 CALENDAR CHKP 100 NOV 11/OCT 11 57.5 CALL @.73 LMT or BUY +1 CALENDAR CHKP 100 NOV 11/OCT 11 55 CALL @.85 LMT could also be good choices. These would be taken off close to expiration, but before earnings.