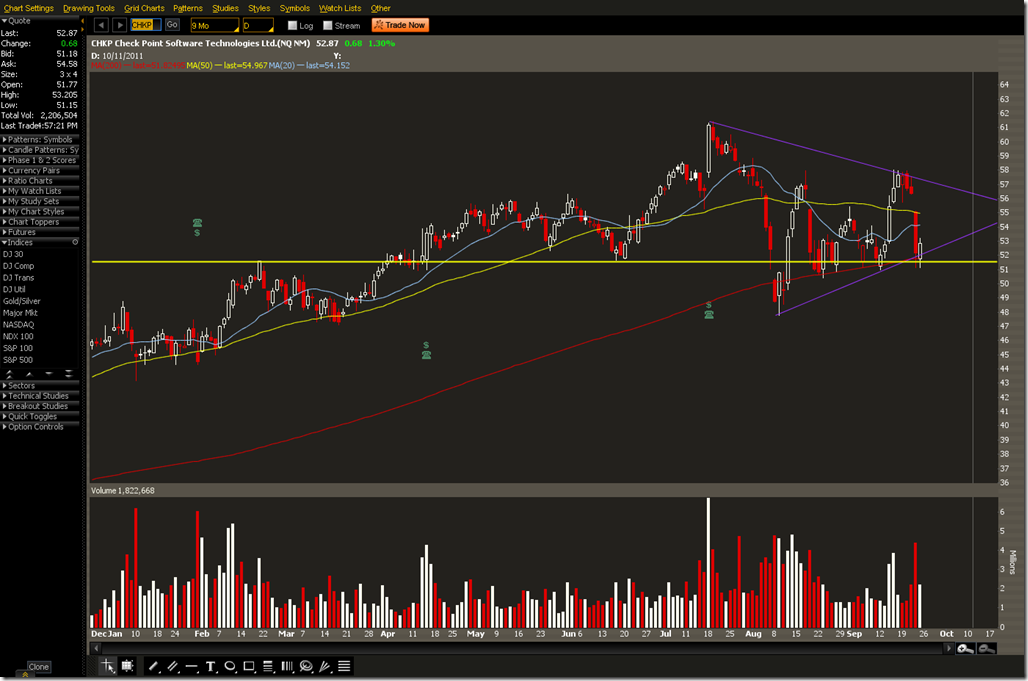

FCFS came up on one of our screens this week. They operate a large number of pawn shops (488) and short term loan stores (124) in The US and Mexico. The economy is not going to turn around for individuals any time soon, so it would be reasonable to make a bullish call on the pawn and payday loan industry. Prior resistance was at the 40 level which has turned into support since then with a few dips below on bad market days. FCFS is also resting on trend line support from February 2010. The 50 SMA is currently around 45 and the 200 SMA is around 40. The 200 SMA is trending up so 40 seems like a reasonable support point.

There are several ways of approaching this trade. An equity limit buy at the trend line with a stop below the trend line for a tight stop, Setting a wider stop below 40 might also be viable, but that’s a $3 loss from where we are right now.

Another angle would be to enter this trade using options.

For this trade we would sell the October 40 PUT at the MID for .45 Then buy the November 35 PUT for .50. This is done for a net debit of .05. The maximum loss is $500 per contract. In this strategy we are looking to get assigned the stock at 40. Essentially we’ve put in a limit order to buy at 40 and are collecting .45 for placing that order. The November 35 PUT acts as a hedge in case the stock has a large decline. At expiration of the October 40 PUT we can roll them into a November 40 Put to create a Bull Put Spread. The MID is worth about 1.35 credit. After accounting for the debit of .05, the net credit is 1.30 If the stock does drop below the short put by options expiration we get to keep the 1.30 credit. The widest stop should be around the 36 level if this is approached as a short term trade. A longer term option would be to accept assignment and sell the long put for an extrinsic/intrinsic value. This approach gives defined risk and allows for multiple exit strategies. As always a good trader should pick the best strategy and stay with it.