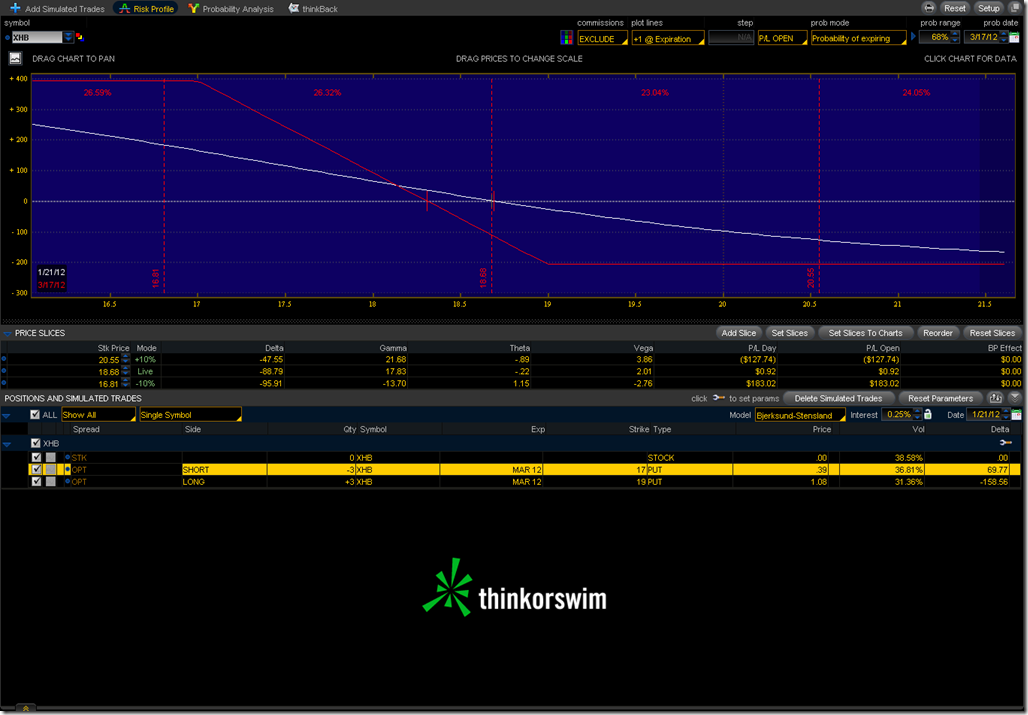

The Shadow Trader ProSwing report announced an entry into a short XHB position. This turned out to be hard to borrow, but there are always options.

Shadow trader suggested the following prices

Price: $18.80

Stop: $19.75

Target: $17.50 (first target)

We’re going to use the ITM March 19 Put and the OTM March 17 Put to minimize Theta. This puts our entry price at $69 per contract. Max gain is $393 per contact on March expiration. Stopping out 19.75 means we lose about $80 per contract. Assuming the direction holds this has a decent risk/reward. One strategy here is to exit when the target is reached, which would be worth at least $115 per contract depending on the Theta loss in the short put.