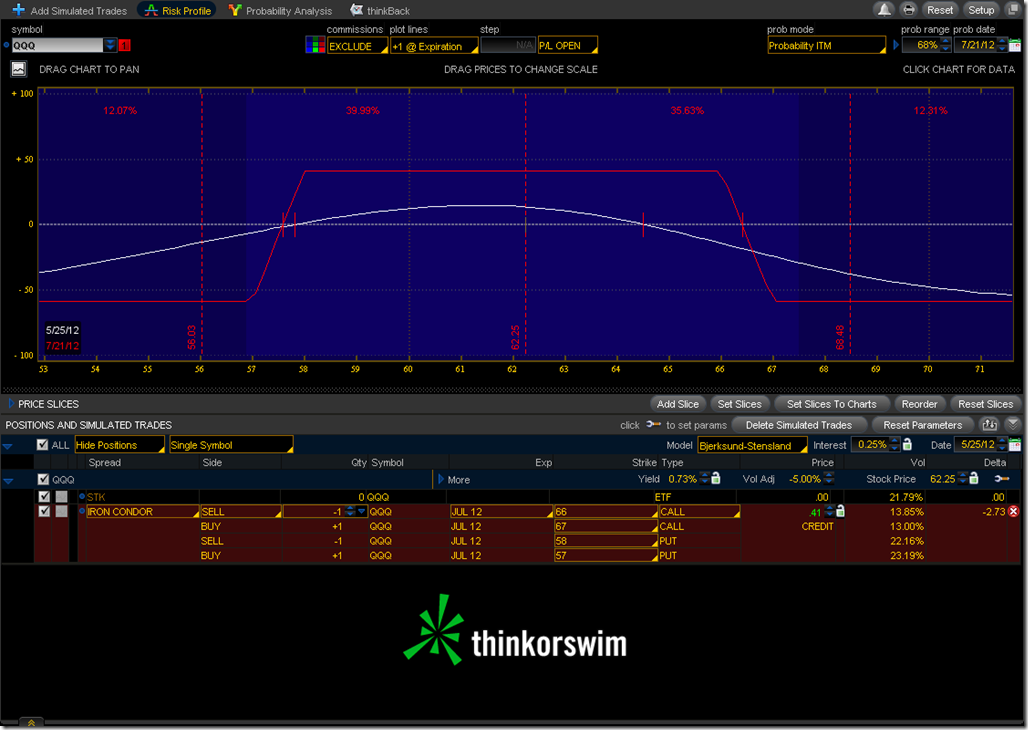

This is a farther dated option strategy than most but the option volatility is good here. First let’s look at an Iron Condor near 30 Deltas. Our max profit is 41 which is good for a 30 Delta.

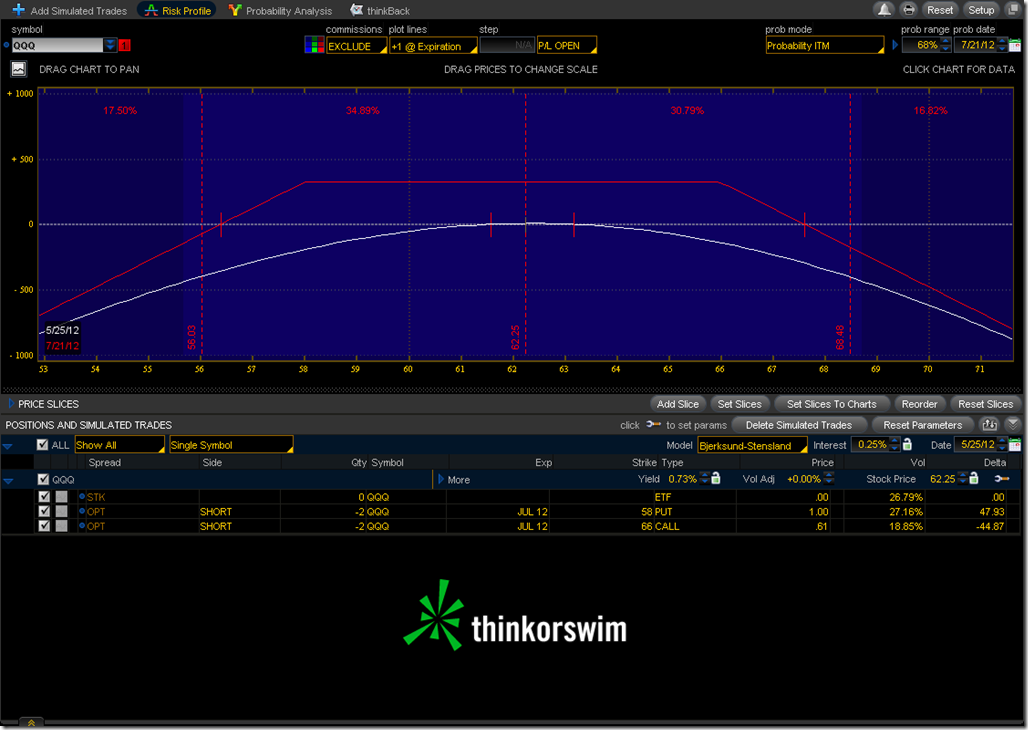

The Strangle provides 1.61 Credit per spread, compared to the .41 per spread for the Iron Condor. This position is Theta positive, but the decay will not affect the position that much for a few weeks. The Strangle provides us with a wide area to profit in. The margin requirement will be higher since these are uncovered options. The advantage is that it takes fewer Strangle give a good credit when compared to the Iron Condor. The P&L curve is also more forgiving as the edges are approached.

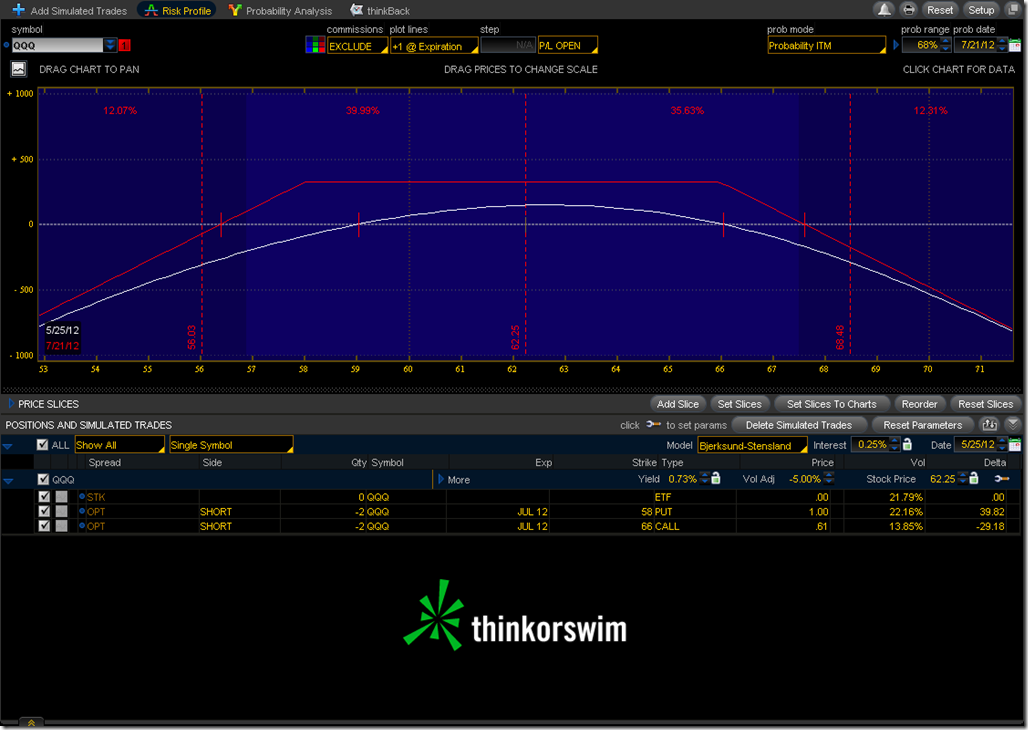

This position will benefit over time, but a reduction in volatility will produce results even faster. If Volatility drops by 5% we can see from the simulation that almost 50% of the max gain can be realized if the price remains close to where it is today. Since the position is slightly Delta positive there can also be a little upside before the gains begin to drop off. If the position moves too much then it is possible to roll both strikes to cover the new range. The Strangle can be an effective alternative to the Iron Condor if your trading size is reduced and if you have the margin available.