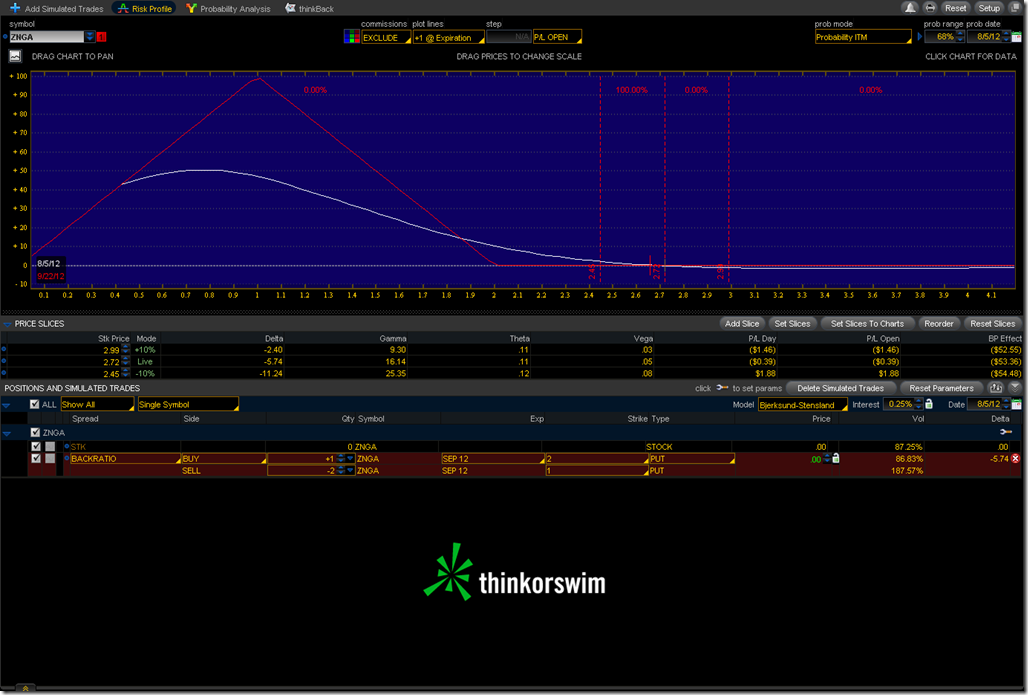

Zynga has been having some trouble since earnings. After a large gap down it continues to move down.

How to take advantage of this? One possible way to attack the topic is with a Back Ratio. The risk is different in this case since the $0 level becomes the lower strikes of a butterfly spread. This was trading for a credit a few days ago which makes this trade a no lose strategy. Over the weekend it’s still a $0 + commissions risk if it stays where it is and if it drops even more it could be worth more. This should be treated like a lottery ticket Butterfly trade. It’s somewhat unlikely the price drop into the profitable range, but if it does this could be a winner with a max profit of around $100 per spread.