XRT is the Retail sector ETF and has been as low as 56 after failing a double top breakout at 63.

It could be possible to sell a call spread against XRT, but there’s another strategy that can be tried. Instead of a regular Butterfly we can look into the 61-62-64 broken wing butterfly for a 0.15 Credit.

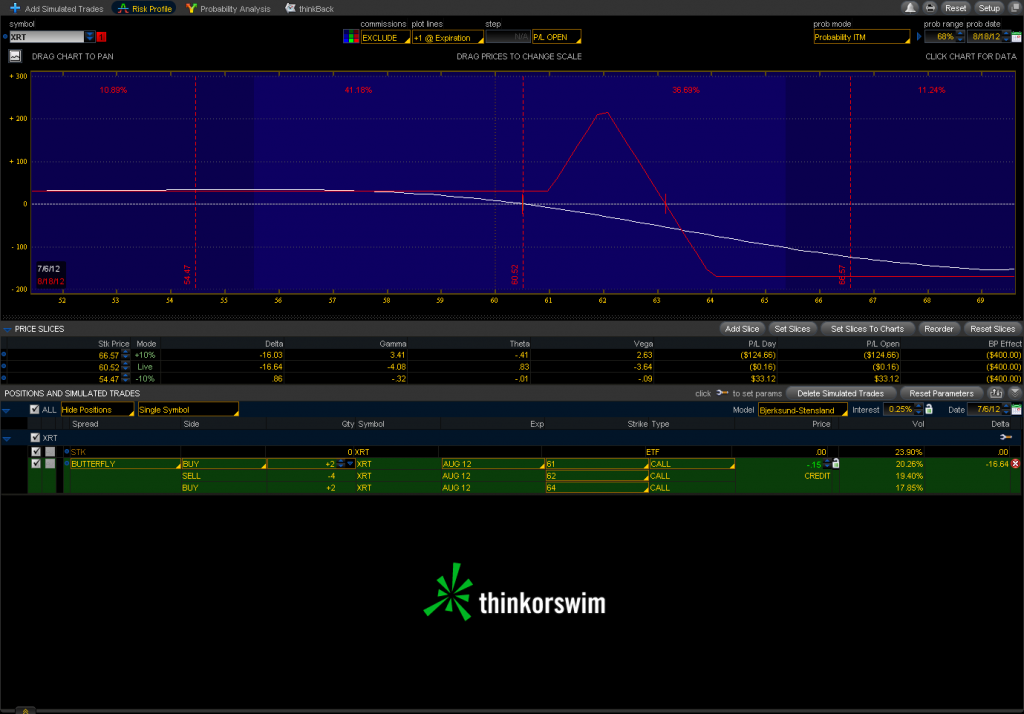

This has some interesting properties. The P/L graph in red is for August expiration on 8/18. Notice that if the underlying ETF goes below 61 it’s still above the zero line meaning it’s possible to make money no matter how low it goes. Between 61 and 63 the P/L turns into a pyramid and then drops off sharply after 63. This is a strategy that one would want to use if you are confident the underlying will not go above the outer wing of the Butterfly. You’re hoping for it to stay stuck in the sweet spot between 61 and 63, as close to 62 as possible by 8/18, but if it drops off from here, there’s no risk to the downside.