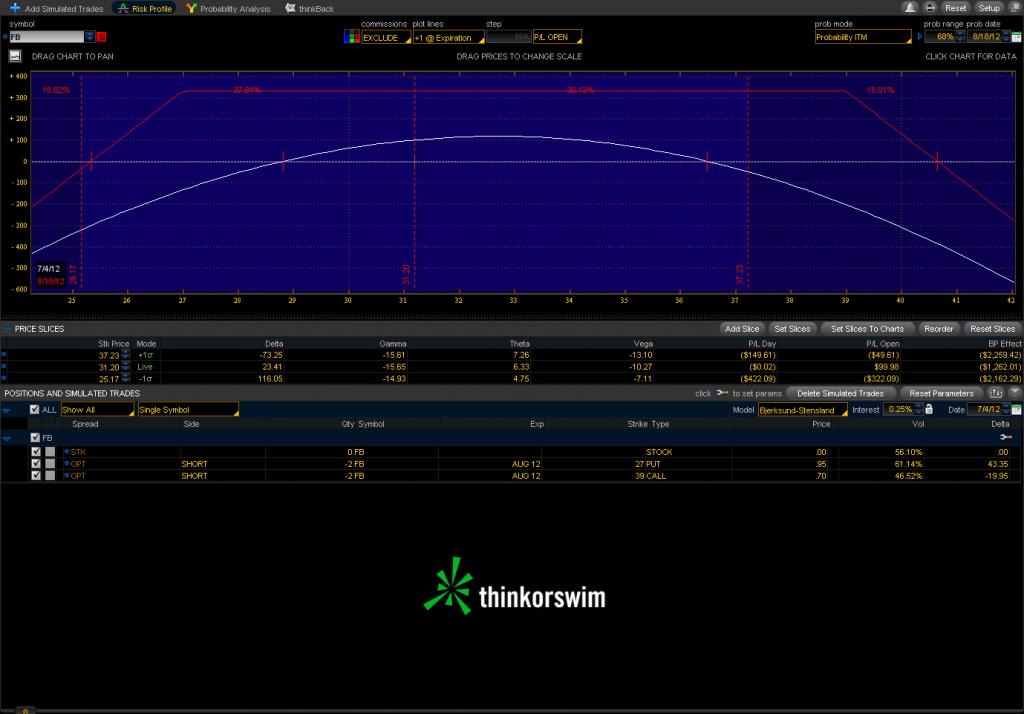

This is another example of using small sized strangles as an income strategy. This is an Aug 27/39 Strangle in $FB. The trade was opened on 6/27 for a .95 and .70 credit on the two strikes. Implied Volitility for August was at 62%. These two strikes were selected at the 20 Delta level. The area on the risk graph is very wide giving a good chance for being successful. One week after putting the trade on there’s approximately a 30.30% gain due to Theta and a 5% reduction in volatility.