Home Depot (NYSE: HD) continues to grow with consumer fears of the data breach well behind us. Consumer behavior continues to demonstrate that the public is not bothered by these events. Earnings and the stock price continue to rise after the breach which goes against the conventional wisdom in Infosec that customers will leave after a breach and that there will be a stock sell off as a result.

If we expect customers to disappear sales should be down, not up. We have to consider the reality of the retail situation. Not everyone is near a Lowe’s (NYSE: LOW) or Ace Hardware. $HD is the only game in town for most shoppers. Even if alternatives are in your area, would you drive out of your way to avoid shopping at $HD? Consumer behavior is driven by price and convenience, not the fear of hackers taking their credit card numbers. Under the Fair Credit Billing Act (FCBA) consumer liability is limited to $50 for fraud. Who is going to drive out of their way for a maximum of $50 in risk? Also consider most credit card companies will eat that $50 due to price matching competition with other issuers. Consumer risk is effectively $0.

The numbers speak for themselves. The latest earnings release from $HD shows that this fiscal quarter the number of customer transactions is up by 3.2%(355.4M) , with an annual increase of 3.3% (344.3M). Net sales are up 5.4% ($20,516M) with EBITDA up 5.7% ($7,185M) . EPS was $1.15 per share. Online sales are up 40% for the quarter and up 50% vs FY13Q3.

The earnings transcript is also quite interesting. The term “security” is only brought up once in the opening remarks.

Before I close, I’d like to briefly comment on the data breach. First, we apologize to anyone impacted by this. From the start, our guiding principle has been to put our customers first. Our customers won’t be responsible for any fraudulent charges incurred through the breach and we will continue to offer free credit monitoring and ID theft protection to any impacted customers. We will continue to invest and enhance security measures to protect our customers’ information.

The statements from Carol Tome, CFO are also interesting in that the breach cost less than $TGT. Also consider that all of this is going to go away due to their insurance policy.

In the third quarter, as a percent of sales, total operating expenses decreased by 56 basis points to 22.6%. Our third-quarter expenses included $28 million of net expenses incurred as part of our data breach. We carry a $100 million insurance policy for breach-related expenses. The gross amount of breach-related expenses incurred in the quarter was approximately $43 million. For the fourth quarter, we are projecting our known gross breach-related costs to be approximately $27 million and after insurance, a fourth-quarter net breach expense of approximately $6 million. For fiscal 2014, given our projected known net breach-related expenses of $34 million, we now expect fiscal 2014 operating expenses to grow at approximately 27% of our sales growth rate

The breach was $28M net. Considering that their sales for the quarter are $20.514B you’re looking at $.028B in net expenses from the breach. There’s a term for that. It’s called a rounding error.

Questions from Wall Street also curiously point to no real effect. JPMorgan (NYSE:JPM) notes that sales slowed in September and then took off in October. The CFO predicts things will go to the upside as nobody on the call says stores are reporting any customer blowback from the breach.

Chris Horvers – JPMorgan Chase – Analyst

Thanks. Good morning, everybody. A couple questions. So can you talk about whether you’ve seen or you saw any impact from the credit breach? What did you hear from stores? What was the pro saying in September, October? September trends did decelerate and then reaccelerate pretty nicely in October. So was curious if you thought any of that was the breach and what you are hearing in the field around it?Craig Menear – The Home Depot, Inc. – President & CEO

Chris, really it’s very difficult for us to be able to determine if there was any impact. We were very, very pleased with the fact that we had positive transaction growth in each month during the quarter. And I think that represents strength for our customers, confidence in The Home Depot and we appreciate that.

Carol Tomé – The Home Depot, Inc. – EVP, Corporate Services & CFO

And don’t mean this to sound defensive, but if you look at a three-year stack, September was our hardest comparison.Chris Horvers – JPMorgan Chase – Analyst

Understood. Right. Okay. And no real like, I guess, your stores aren’t communicating anything up to you that’s conclusive in either direction?Craig Menear – The Home Depot, Inc. – President & CEO

No.Chris Horvers – JPMorgan Chase – Analyst

Okay. And then as a follow-up, Carol, curious if you could talk about your thoughts on November. Of course, you said nothing has come to your attention, but you’ve heard a lot of retailers speak to a pickup or at least as good as sort of the trend from 3Q. So was curious how you would describe your view of November.Carol Tomé – The Home Depot, Inc. – EVP, Corporate Services & CFO

Happy to talk about our perspective on November in the fourth quarter. As you know, it’s always tricky to forecast where sales will go in the fourth quarter because we’re heading into winter and I don’t know about where you are, Chris, but it’s mighty cold here in Atlanta. That being said, we are two weeks into November and I must say that I’m impressed with the sales that we’ve reported to date. So if there’s a bias in our forecast, I would say the bias is to the upside.Chris Horvers – JPMorgan Chase – Analyst

Thanks very much. We like the word impressed. Good luck in the fourth quarter. Thanks, guys.

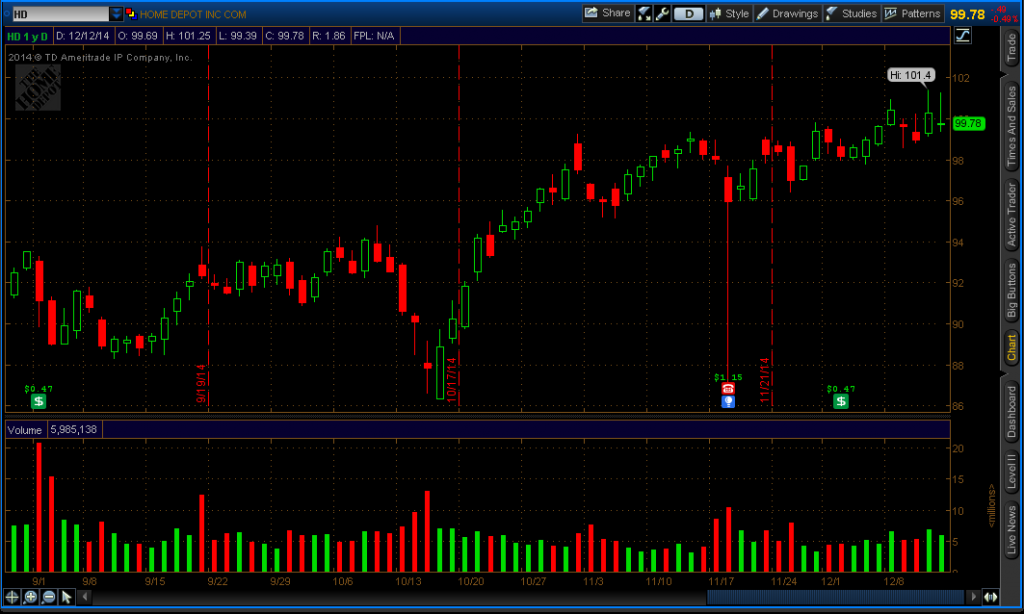

The stock is up about 10% since the breach. You don’t want to be on the wrong side of the trade like this person. Evidence suggests you never short a breach. You will be destroyed. You have to buy in before anyone else does. You have to buy the dip.

$HD: shorted this bad boy at $90 and have been destroyed. skyhigh expectations being dashed are my only hope for redemption

— tryingtomakeabuckinthemarket (@contrarianspeculator) Dec. 13 at 12:32 PM